Letter to Shareholders: 2018 Year End

April 30, 2019

Dear Shareholder,

2018 was an eventful, high-paced and very successful year for Atlas Engineered Products (AEP). Since our launch in November 2017 we have acquired and merged 6 companies into the AEP family and acquired the plant and equipment of a 7th company at a discount to bolster our manufacturing operations and increase capacity.

The speed with which we are growing is a key part of our first mover advantage and business strategy. The industry is fragmented, made up mostly of independent operators producing specialized products. One firm may only makes trusses. Another might also make wall and floor panels. Another may produce just windows or doors. We’re consolidating these narrow focused operations and delivering a fully integrated service to builders and developers both big and small.

What we are doing is revolutionary and disruptive. We can build better, customized components for residential homes and commercial spaces, faster and on time.

The current approach is known as “stick construction”, meaning loose pieces of lumber are delivered and framed up on site. It is a fairly rudimentary construction technique. It’s weather dependent, and it’s time and labour intensive. Quality control can be insufficient or poorly tracked.

In our facilities in BC, Ontario and Manitoba, we use laser precision, software and automation to manufacture a full range of engineered products, in a controlled indoor factory environment using standardized best practices. The components are then brought on site and quickly assembled in weeks not months.

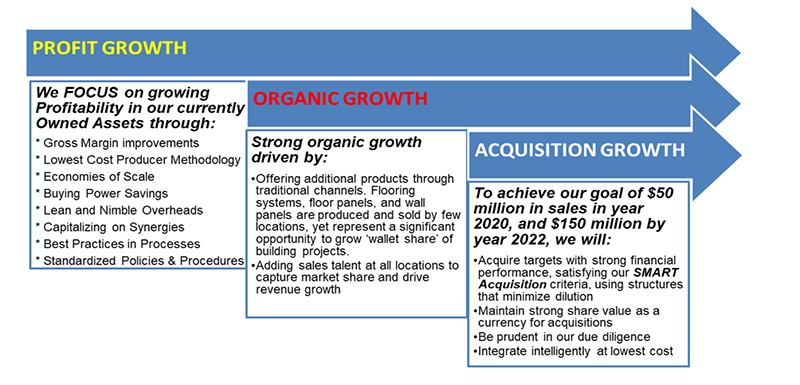

Most importantly, there is a huge opportunity for growth. Not only through acquisition but also through strong organic growth and improvements that contribute to bottom line profits at each and every business unit.

For example, AEP’s Atlas Building Systems division in Nanaimo reported 19% revenue growth. Clinton Building Components in Clinton ON reported 24% growth and Satellite Building Components in Merrickville, ON also demonstrated double-digit revenue growth. This significantly improved year-over-year performance can been seen in our recent financials. And it is important to note that when you remove restructuring costs, integration costs, and improving plant costs - both EBITDA and Net Income are positive.

Upon joining AEP In November 2018 my mandate and top priority was to get this young organization to profitability as soon as possible, ideally by the end of 2019. To that end we are increasing cashflows and strengthening the balance sheet. Secondly, we put huge emphasis on strong organic growths through market and customer expansion, as well as through product diversification. Thirdly, as highlighted above, growth through acquisition.

Let me share with you some business highlights from 2018:

Organizational Leadership – We consolidated our executive team and established strong regional leadership at each facility who report currently directly to me. As part of this process we terminated several executive and senior leadership positions and achieved significant annual savings as a result;

Staffing Review – We launched a review of every position and function at every plant, put a freeze on hiring, and actively sought opportunities to consolidate functions and/or share some functions across the group (i.e. shared financial and/or administration functions, or design capacity, etc). Though we made steady progress by year-end, this activity will continue into 2019, as we evaluate employment levels, cost saving opportunities and/or increase productivity per man hour;

Non-Essential Services – We terminated several non-essential service contracts to AEP and have paused others for review;

Cash Drive & Cost Controls – Our team instituted stringent cost and cash management controls which were in full swing at year’s end. We will continue this program into 2019;

Buying Power – One area of strategic focus is the ability to centralize procurement and pooling group volumes together to drive material costs down. We will complete this process in 2019;

Operational Excellence – Although we are a new company, we have the advantage of having team members with lifetimes of experience in the industry. Armed with that expertise, we commenced a review of manufacturing flows, productivity, efficiency and wastages. By addressing improved work flows, adding automation in some instances, re-allocating some equipment throughout the group, we can continue to achieve significant productivity and gross margin gains;

Sales Staffing – We expanded our Sales Group to add more feet on the street, and to increase market and customer coverage, as well as grow revenues and target specific new markets;

Product Development & Expansion – Currently about 85% of the AEP Group’s revenue is generated through Roof Truss sales. We have the capability and capacity to expand into complimentary product streams such as Floor Trusses, Engineered Wood Products, as well as open and closed wall panels at all our locations. This could more than double our addressable market and support our growth objectives. We have already started this process at our Nanaimo facilities and we target roll-out by Q2 2019. We will implement customized Product Expansion at one facility after another throughout 2019/20;

Design & Engineering Capability – It is crucial that we establish ONE Design Platform across the group. This will ensure we can share designs, standardize methodologies, and implement quality control throughout the organization. We have worked with service providers and operational teams to transition to this Platform in early 2019;

The above are just some of the examples from our comprehensive Strategic Business Plan. We have built an excellent and expanding team, and I am confident we can deliver on this aggressive, yet realistic and achievable plan.

Below are a few highlights from the 2018 year-end financials. I encourage you to read our complete Annual Consolidated Financial Statements and Management Discussion & Analysis for more detail. I want to thank you for your support to date and look forward to continuing to create value for our shareholders in the months to come. Please contact me directly if you have any questions or concerns.

The 179 individuals of AEP are inspired by the possibilities of our future. We hope you are as well.

Sincerely,

Dirk Maritz, CEO & President

2018 YEAR-END RESULTS

- Revenue of $13,352,676 vs. prior year of $11,597,176

- Gross profit of $3,111,229 (23.3%) vs. prior year of $2,871,826 (24.8%).

- Adjusted EBITDA of $(661,421) ((5.0%) of revenue) vs. prior year of $1,420,554 (12.2% of revenue).

- Normalized EBITDA of $1,247,925 (9.3% of revenue) vs. prior year $1,539,954 (13.3% of revenue), after one-time costs added back.

- Net loss of $1,250,086 (EPS $0.04) vs. prior year of $4,954,765 (EPS $0.29)

- Normalized Net income before tax of $659,260 (4.9% of revenue) vs. prior year $29,421 (0.3% of revenue), after one-time costs added back.

This letter was sent to AEP shareholders on April 30, 2019 at 11:46 AM. To sign up for email alerts from Atlas Engineered Products, click here.