CEO & President Letter to Shareholders 2019 Financial Results - 2020 Outlook

April 30, 2020

Dear AEP Shareholders,

During these unprecedented times, we hope that you and your loved ones STAY SAFE and STAY HEALTHY. To date, all AEP operations in all locations have been deemed essential businesses and we are busy working to supply our customers across Canada. We continue to closely monitor developments in the COVID-19 pandemic and to respond to provincial and federal updates with the urgency required. We have developed a proactive company-wide strategy to how we navigate the potential impacts to AEP, maintain our social responsibilities, and minimize the spread of the Coronavirus (COVID-19). We have a solid business continuity and interruption plan, which we are diligently executing.

BUSINESS UPDATE - YEAR 2019

Reflecting on 2019, I am both humbled and pleased to share with you that AEP has met, and in some cases exceeded, our expectations.

2020 marks AEP’s third year as a public company and we believe it is an opportune and appropriate time to share our progress to-date, comment on what we see as our path forward, and showcase to you, our shareholder, some key messages for 2020 and beyond.

Despite the current challenges we are overcoming and the unknown future effects of COVID-19, as it relates to our business, AEP is in a strong financial position. We have liquidity and we have kicked off a new financial year in a superior financial position, with a strong orderbook, an exceptional turn-around in 2019 and, successfully closing an oversubscribed Private Placement for gross proceeds of over $4.5 million in Q1 2020.

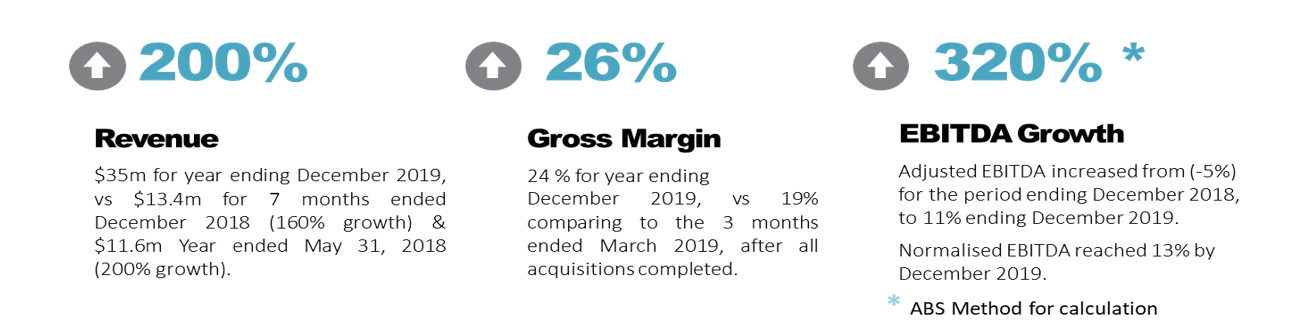

After a challenging 2018, and a slow start in Q1 2019, we demonstrated exceptional revenue growth for the full year ending December 31, 2019. Total revenues for our year ended December 31, 2019 were $34.7 million compared to $13.4 million for the 7 month year ended December 31, 2018 (an increase of 160%) and $11.6M for the year ended May 31, 2018 (an increase of 200%). Gross margins were also significantly improved by the year ended December 31, 2019 as compared to the start of 2019. After beginning the year with a gross margin of 19% for Q1 2019, we finished with a gross margin of 24% for Q4 2019. Our gross margins for Q4 2019 were also reflective of our gross margins for the entire year ended December 31, 2019, and comparable to our gross margin of 23% for the 7 month year ended December 31, 2018 and 25% for the year ended May 31, 2018. Success was achieved by tremendous organic and acquisitive growth, as well as improvements from our integration activities. The steps taken in 2019, including costs incurred for development and structures, have laid the framework for AEP to thrive and succeed in 2020 and beyond.

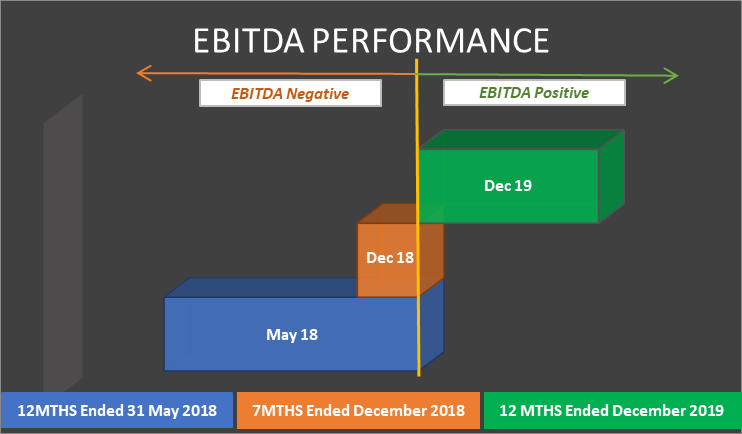

A number of projects scheduled for the end of 2019 were moved into spring & summer 2020. This did impact Q4 2019 performance however, overall we successfully executed a tremendous turn-around in the last three quarters of 2019. We exceeded our EBITDA targets and ended the 2019 year with a Normalized EBITDA Margin of 13% and an Adjusted EBITDA Margin of 11%. This was a significant improvement over our Normalized EBITDA Margin of 9% and Adjusted EBITDA Margin of -5% for the seven months ended December 2018. The Company also experienced significant growth in EBITDA performance from our year ended May 31, 2018 (-36%), and the seven months ended December 31, 2018 (-7%), to our current year ended December 31, 2019 (8%) as shown in the graph below.

During the year ended December 2019, we took a disciplined and prudent approach to our balance sheet. There was an assessed impairment of Coastal’s goodwill, and the Company elected to write off the balance to save future costs of goodwill testing. A loan receivable, originating in 2017, was written off due to lack of principle repayments received during the latter part of 2019. We believe that it was sensible to complete these write-offs, even though the Company intends to pursue these funds. Other one-time or non-recurring costs that affected our year end results included: ongoing restructuring and severances as we continue to combine functions and maximize synergies, developmental costs, and a ramp-up in organizational costs for anticipated product launches and acquisitive activities. The balance sheet adjustments, and one-time or non-recurring costs accounted for approximately $1.1m, pushing the business to negative net income for the year.

Here is a brief recap of our accomplishments for Fiscal 2019:

- AEP evaluated and developed integration plans to address operational and financial improvements in the newly acquired companies;

- In the spring of 2019, the acquisition of SC Building Systems in Manitoba allowed AEP to enter the Prairies and expand into new geographical markets. Meanwhile, we penetrated the North and South Vancouver Island markets and targeted areas in Ontario to ensure a comprehensive national footprint of product and service delivery;

- We aggressively focused on product diversification, thereby delivering record revenues which successfully generated significant improvements in EBITDA.

BUSINESS OUTLOOK

AEP’s 2020 revenue objectives include reaching an annualized revenue run rate of up to $45 million and an EBITDA margin of 10-15% with our existing operational footprint. We regularly assess and test the achievability of our 2020 targets, especially due to the current economic conditions associated with the COVID-19 pandemic. As mentioned in prior releases, AEP exceeded the Q1 2020 revenue targets when compared to objectives.

Based on current results, factoring in the projected impacts of the COVID 19 pandemic and the historical seasonality of the construction industry, AEP management believes that it will reach its 2020 objectives. Targeted acquisitions, new products and sales staff in specific regions, and continued cost improvements will all contribute to AEP reaching its targets.

Canada’s peak construction season typically starts in May and, as previously announced, we continue to secure more and more jobs. In addition to the work we carried forward into 2020, we are starting to see a healthy workload moving forward.

Even during the COVID-19 pandemic, our BC operations continue to achieve volumes above 2019 for the comparable fiscal period. Quoting levels and project wins are also increasing in Manitoba as winter is finally coming to a close and restrictions are scheduled to be lifted. Ontario is still in the midst of the pandemic, but the Provincial Government has developed plans to begin re-opening its economy. Although AEP is marginally impacted in Eastern Canada on top-line revenues, we are cautiously optimistic that we will start seeing a strong pick-up in demand moving into the primary construction season as quoting levels are starting to rise in the regions we serve.

Looking forward to rest of 2020 and beyond:

- We started 2020 in the best financial position in the AEP’s history on the back of a phenomenal turn-around in 2019 and successfully closing an oversubscribed Private Placement for gross proceeds of over CAD $4.5 million;

- We will continue to be focused, fiscally disciplined, action strategic on-going improvements, and target activities aimed at margin expansion;

- We will continue to assess our financial and capital structures to optimize our future profitability; and

- AEP maintains a perpetual view of expanding existing territories, while growing organically into new markets. AEP will also continue to actively assess and negotiate acquisitions during a time of great valuation opportunities.

SHORT-TERM PROFITABILITY VS. CASH PRESERVATION

We have implemented rigorous social distancing initiatives in our operations (e.g. creating safe physical distances between employees by expanding the areas between workstations and utilizing more surface area on equipment), promoted and implemented remote working, established clear hygienic protocols, employed new/advanced technology protocols, and scheduled maintenance activities typically scheduled in other times of the year. These critical and necessary activities are expected to result in some reduced productivity, and/or efficiency, resulting in a higher cost profile and potential impact on some product margins.

We have also looked at a wide variety of cash preservation options, including a focus on “cash first priorities”; in some instances these activities compete with AEP’s short-term profitability. However, these strategies are designed to preserve the cash in the event of business interruptions, and therefore protect and reinforce our strong financial position as well as our ability to weather this virus.

We assertively scaled the business to current revenue profiles, laid-off non-essential positions and terminated non-essential contracts (including those filled to support strategic partnerships and potential acquisitions in early 2020). We evaluated all areas of the business and reduced hours to match any reductions in work and/or projects. The AEP Senior Leadership Team also took a salary sacrifice in the interim.

These short to medium term initiatives will have a major impact on how AEP will operate in 2020. Cash is King and our business continuity plan should help to ensure that we maximize every dollar and cent.

Although COVID-19 is unprecedented, things are looking promising in the regions we serve. AEP continues to plan and adapt. AEP is well capitalized, liquid, and fiscally disciplined. AEP also continues to win significant new contracts. All of these factors should allow us to carry ourselves now and into the future.

PRODUCT DEVELOPMENT & DIVERSIFICATION

During 2019, we executed on our plan to develop and commercialize new product offerings such as wall panel manufacturing, engineered wood supply, and floor truss manufacturing. AEP has invested time and resources to develop internal capabilities and successfully execute on our product diversification strategy. Onsite pilot projects, and the development of required design and production knowledge, have resulted in extra up-front and implementation costs which had an impact on our gross margins in Q4 2019. We are now in the final stages of implementation, allowing AEP to successfully introduce new products to customers in new territories, from all of our locations.

Our ability to provide an array of products to each of our customers has the potential to significantly increase our wallet share of each of their projects as we enter the 2020 building season. We won several contracts across these new product lines in 2019 and into 2020. To date we have successfully delivered wall panels, engineered wood, and roof trusses to a boutique hotel and numerous residential projects in Ontario. Into 2020 and beyond, we believe the additional revenues from this product diversification strategy will continue to drive strong organic growth rates.

PROFESSIONALIZING OUR SALES & DESIGN TEAMS

Upgrading the design software to a standard, best-of-class, platform across our locations not only led to significant productivity and efficiency gains in our existing products, but it gave us the design capability to successfully roll out diversified products as well. We now can continue to distinguish ourselves as a true solutions provider in the engineered wood, roof truss, structural floor product and prefabricated wall verticals in the residential, multi-residential, light commercial and industrial construction building sectors. Our last software implementation, at our SC operation in Manitoba, was completed in Q1 2020.

We have also added new sales staff across the Company, establishing a professional sales system and process, instilling sales discipline and focused leadership, and resulting in a growing order book. Our new sales team transitioned many of the previously held sales relationships to a professionally managed salesforce, assessed and targeted new geographical markets to cover and penetrate, and developed new market segments within established geographies. Today, we have expanded our customer profile to include lumber yards, single and multi-residential residential builders and developers, subdivision developers, and light commercial and industrial developers such as hotels, community shopping and services centers, social infrastructural developments and more. The increased quoting activity, at several locations, is a great indicator of success from the additional salespeople.

PRODUCTIVITY, INNOVATION & TECHNOLOGY

In 2019, we made significant improvements to workflows, enhanced efficiencies and increased productivities at all of our locations. Given that Q1 is historically the slowest construction quarter, in Q1 2020 we continued to focus on improving productivity that will improve results in ensuing quarters. As was the case in Q1 2019, in Q1 2020 we had capital and maintenance expenditures to line AEP locations up for continued margin expansion for the rest of the year.

On the Equipment side, in Q1 2020 we:

- Purchased a new world-class, quick and precise component saw for our Atlas operation. This new saw replaced several pieces of equipment, adds approximately 60% extra capacity, as well as increases quality and control;

- Procured a truss manufacturing table and a saw as well as transferred saws from the assets acquired from Alberta Truebeam Ltd. (“Truebeam”), for our Clinton operation;

- Transferred and installed manufacturing tables, from Truebeam, at our Satellite operations to increase capacity and productivity;

- Allocated delivery trucks, from Truebeam, to our Satellite and Clinton operations. All assets from Truebeam are now allocated to specific AEP locations, which will increase capacity, resulting in increased revenue generation and/or productivity at those; and

- During 2020/21 our capital needs are focused on further workflow improvements and automation activities. We target automating some key manufacturing stations that will lead to significant labor savings and improve quality tremendously. These upgrades will be fully integrated into our manufacturing and design control systems and we expect will have impressive paybacks as a result.

On the Technology side, in Q1 2020 we:

- As mentioned before, we upgraded ALL of our locations to a leading platform of design and engineering. This is cutting edge design and manufacturing technology strategically connects with our targeted standardized ERP development, planned for the backend of 2020. The systems will fully integrate into our operational management and control systems and will contribute to maximizing synergies and eliminating duplication across the group;

- We developed new websites for AEP and the operating companies, as well as redesigned our social media presence in platforms such as Twitter, LinkedIn and Facebook;

- Our team selected and implemented a standardized business and productivity suite and successfully migrated all accounts;

- During Q1 2020, we fast tracked several technology platforms, communication and security protocols, installed remote working stations and infrastructure to quickly and efficiently adapt our work environment to a COVID-19 reality; and

- We reviewed all operation and group IT infrastructure and earmarked our infrastructure development plan for 2020-2023.

INSIDER OWNERSHIP

Since the beginning, insiders have held significant ownership positions in AEP, participating in multiple financings. I am proud to recap that insiders and employees hold approximately 35% of shares outstanding. I believe that speaks volumes not only to the alignment with our shareholders, but also the confidence that insiders have in the future and direction of AEP. I am reassured by the fact that the individuals (Board, Leadership and Employees) who have the most insight into AEP, are also among the most vested in the outcome of decisions made.

FINANCING

AEP has been strategic in its financing. Proceeds from our 2018 private placement partially financed our Pacer and South Central acquisitions, both which added significant revenues to AEP. Proceeds from our February 2020 private placement are earmarked for our 2020 acquisition plan, capital needs and working capital. This financing was oversubscribed and, again, insiders contributed significantly.

Based on our current financial position and belief that cash flows from our existing operations will remain steady, AEP is well capitalized to execute on its strategic plan for organic and inorganic growth.

CURRENT DEBT FACILITIES

The Company’s debt can be broken into 4 categories as follows:

- A revolving credit facility– AEP has a CAD $1.75 million revolving credit facility by a major Canadian bank. It may be used for working capital purposes if required. We confirm that this facility is current undrawn;

- Term loans– Each term loan has an amortization between 5-7 years and was acquired to assist with the completion of our Clinton, SC, and Pacer acquisitions;

- Mortgage Debt– All properties we have acquired from acquisitions have mortgage debt on those locations. This has allowed us to maintain cash while having a loan that is amortized over 15-20 years. We continually evaluate whether owning our plants is desirable and analyze sale and leaseback opportunities in determining the optimal capital structure for the business; and

- Equipment Debt– The Company has various assumed and new equipment, and vehicles, under financing or under a leaseback program with our main financial institution.

THE AEP OVERARCHING STRATEGY

Our accelerated success in 2019 was achieved through internal operational improvements, solid integration practices and organic growth, which led to greater profitability. We also remained focused on the goal of identifying qualified, accretive acquisition targets. We believe that market trends remain in our favour and, under current conditions and succession demographics, we continue to see attractively priced target companies; we will prudently and aggressively look to take advantage of acquisition opportunities. With shortages of skilled labour continuing to drive demand for assembled components and engineered products, as well as the inability of independently owned and operated companies to match required investments for latest technologies, AEP finds itself in a very strong position to continue growing profitably.

I have highlighted multiple times that AEP has a “First Mover Advantage” in consolidating a highly fragmented, multi-billion-dollar industry. This industry faces severe succession challenges and significant segmentation that have contributed to small regional players that do not have the leverage to reduce costs or make significant investments in equipment and/or technology. I continue to believe that AEP is a truly compelling story.

Our view is that each business acquired, or each new location opened organically, will integrate into the group in an organized and disciplined fashion. We created a well-defined integration strategy in 2019. With this strategy, we have proven that we can synergize and create a growing stable of businesses in multiple locations that each will produce positive cash flows. With a goal of compounding revenues and profits, positive cash flows will be strategically reinvested, either at the local level, if the rationale is compelling, or into other areas that hold higher return potentials.

We have operations in our portfolio currently generating EBITDA higher than the original contribution of cash paid for their acquisition. This underlies our belief that our operations and AEP can generate high returns on invested capital in the long run. We continue to work this formula for success through all our operations.

I am often asked about acquisition structure and, specifically, the deal mechanics and transaction size. As part of our Smart Acquisition Criteria, we consider both small and large opportunities. Based on history, we have demonstrated our ability to find and complete multiple types of acquisitions. The advantage of operating in such a fragmented industry is the ability to increase the number of acquisitions in a given year if circumstances warrant or to consider larger transactions if the risk profile is appropriate.

IN SUMMARY

We are living in an extraordinary world, during unprecedented times, where the spread of COVID-19 has impacted communities globally and created immense uncertainties. All of AEP’s operations continue to be deemed essential service businesses at each location in which we operate.

AEP is a healthy and fundamentally sound business. We continue our journey of impressive growth, and we have made significant progress with margin expansion. We have liquidity, a healthy amount of cash, and a well-defined and implemented cash preservation strategy as a part of our business continuity and interruption plan. We believe that we are well positioned to weather a storm. Our plan includes scaling down our costs and cash outflows to match with revenues changes where and when applicable.

AEP is well positioned, looking forward. We are encouraged that monetary and fiscal stimuli applied by governments world-wide will positively affect our industry. With winter coming to an end, we are starting to see an increase in business activity by our customers and partners. Our geographical spread continues to prove to be a major asset during this pandemic.

We remain customer-focused, providing quality solutions and products, achieved through operational excellence. I am both humble and proud of our amazing group of employees that continue to deliver extraordinary results through their dedication and commitment – and we have only just started!

Regards,

Dirk Maritz,

CEO & President

For further information please contact:

Atlas Engineered Products Ltd.

Phone: 1-250-754-1400

Email: [email protected]

Unit 102, 6551 Aulds Road

Nanaimo, BC V9S 5X9

www.atlasengineeredproducts.com

For investor relations please contact:

Brittany Ray-Wilks, Executive Vice President

Phone: 1-250-754-1400

Email: [email protected]

Atlas Engineered Products Ltd.

Unit 102, 6551 Aulds Road

Nanaimo, BC V9S 5X9

www.atlasengineeredproducts.com

Forward Looking Information

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Although AEP believes that the expectations reflected in the forward looking statements are reasonable, there is no assurance that such expectations will prove to be correct, or that such future events will occur in the disclosed time frames or at all. AEP cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond AEP’s control. Such factors include, among other things: Risks and uncertainties relating to AEP, including those to be described in the Management’s Discussion and Analysis (“MD&A”) for AEP’s year ended December 31, 2019. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, AEP undertakes no obligation to publicly update or revise forward-looking information.

Selected Financial Information

Except as noted below, the financial information provided in this news release is derived from the AEP’s audited financial statements for the transition year ended December 31, 2019 and the related notes thereto as prepared in accordance with International Financial Reporting Standards (“IFRS”) and related IFRS Interpretations Committee (“IFRICs”) as issued by the International Accounting Standards Board (“IASB”). A copy of AEP’s audited financial statements for the transition year ended December 31, 2019 and the related Management’s Discussion and Analysis is available on AEP’s website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com.

Financial information for AEP’s acquisitions are included in AEP’s audited financial statements from the date of acquisition. Financial information for acquired businesses for periods prior to the date of acquisition were prepared by management and have not been reviewed or audited by independent auditors.

Non-GAAP / Non-IFRS Financial Measures

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP’s operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release include “EBITDA”, “EBITDA margin”, “adjusted EBITDA”, “adjusted EBITDA margin”, “normalized EBITDA” and “normalized EBITDA margin”. “EBITDA” is calculated as revenue less operating expenses before interest expense, interest income, amortization and depletion, impairment charges, and income taxes. “EBITDA margin” is EBITDA expressed as a percentage of revenues. “Adjusted EBITDA” is EBITDA after adjusting for share-based payments, foreign exchange gains or losses and non-recurring items. “Adjusted EBITDA margin” is adjusted EBITDA expressed as a percentage of revenues. “Normalized EBITDA” is EBITDA adjusted for one-time items. “Normalized EBITDA margin” is normalized EBITDA expressed as a percentage of revenues.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.