Atlas Engineered Products Reports Record Q3 Results Record Q3 Revenues, Increase of 81%

November 16, 2021

November 16, 2021 - Nanaimo, British Columbia / Atlas Engineered Products (“AEP” or the “Company”) (TSX-V: AEP; OTC Markets: APEUF) is pleased to announce its financial and operating results for the three and nine months ended September 30, 2021. All amounts are presented in Canadian dollars.

“I am incredibly proud of the AEP team with their dedication and resilience in producing these record results,” said Hadi Abassi, AEP’s CEO, President and Founder. “The mandate for our team this year was improving AEP’s bottom line results and I couldn’t be happier with the results as we achieved net income of almost $4.5m for the year to date!”

Financial Highlights for Q3 2021:

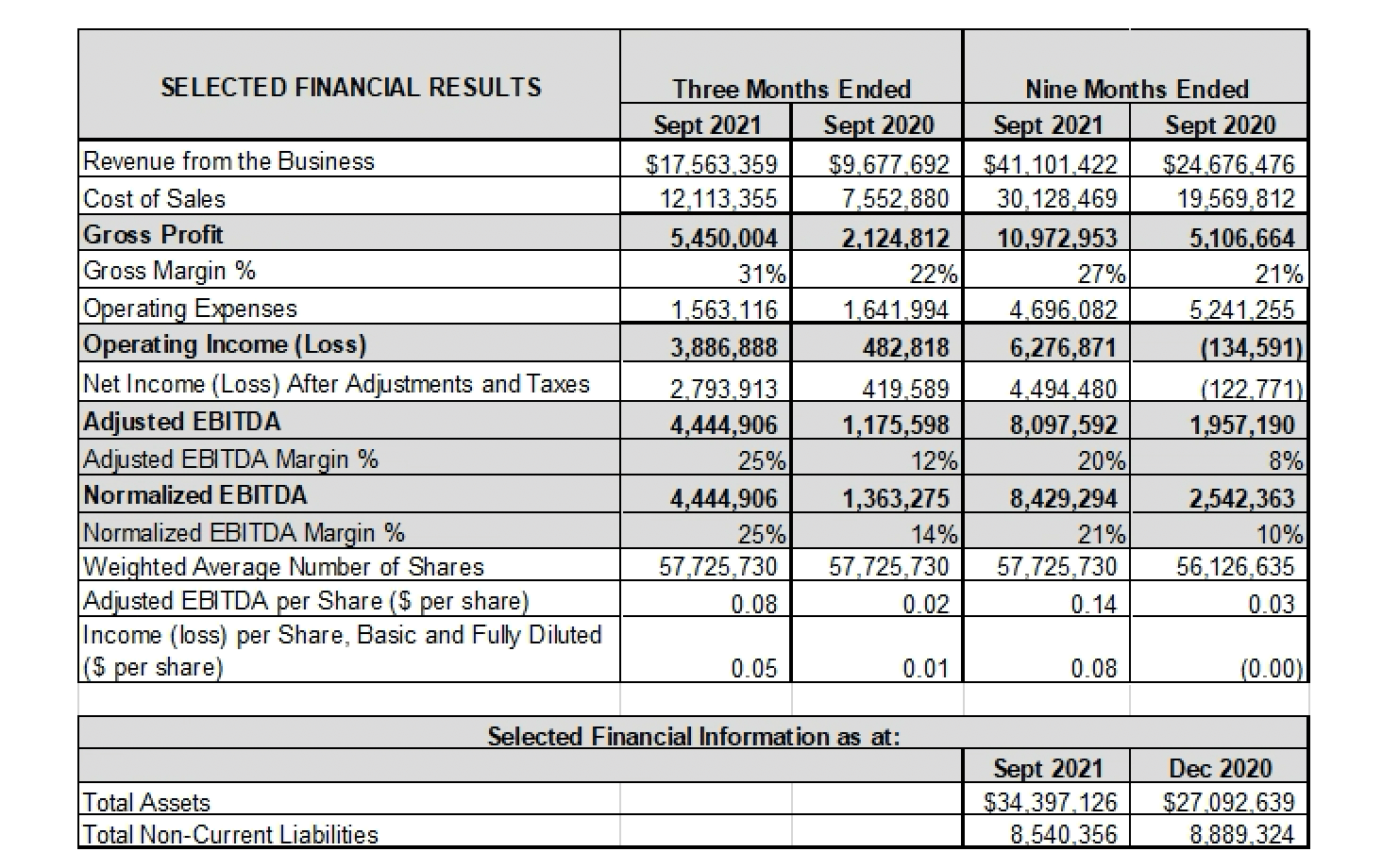

· Revenue increased by 81% to $17,563,359 for the three months ended September 30, 2021 compared to $9,677,692 for the three months ended September 30, 2020. This increase represents the Company’s best Q3 results to date. Revenue also increased 67% to $41,101,422 for the nine months ended September 30, 2021 from $24,676,476 for the nine months ended September 30, 2020. The Company’s revenues of $41,101,422 for the nine months ended September 30, 2021 exceeds revenue results for the entire year ended December 31, 2020 which was $35,734,415.

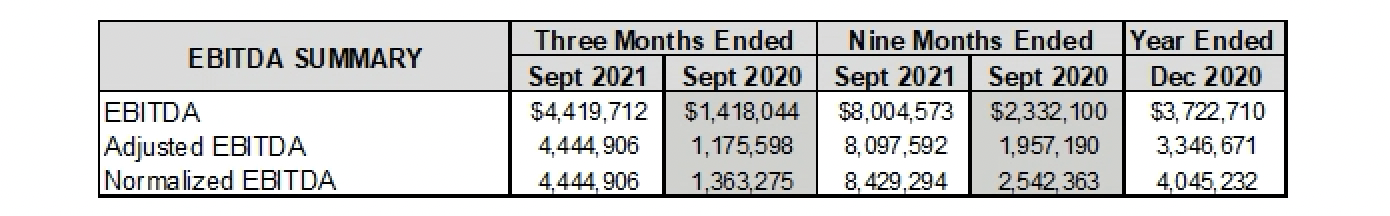

· Non-IFRS measure normalized EBITDA increased by 226% and 232% to $4,444,906 and $8,429,294 for the three and nine months ended September 30, 2021 compared to $1,363,275 and $2,542,363 for the three and nine months ended September 30, 2020. This turnaround was due to increases in revenues and gross margin, and reduced operating expenses. Normalized EBITDA of $8,429,294 for the nine months ended September 30, 2021 has more than doubled the Company’s normalized EBITDA for the full year ended December 31, 2020 which was $4,045,232.

· Gross profits for the three and nine months ended September 30, 2021 of $5,450,004 and $10,972,953, respectively, were more than double gross profits for the three ($2,124,812) and nine months ($5,106,664) ended September 30, 2020. Gross margin for the three months ended September 30, 2021 was 31%, up from gross margin of 22% for the three months ended September 30, 2020. Gross margins also increased to 27% for the nine months ended September 30, 2021 from 21% for the nine months ended September 30, 2020 due to the Company’s hard work navigating and controlling pricing during the rising raw material prices and shortages and now the reducing raw material prices, while constantly focusing on improving efficiencies for new product lines and acquisitions. Additionally, the manufacturing equipment bought at the end of January 2021 also improved automation at one of AEP’s facilities, with the ability for improved efficiencies within our core product lines.

· The Company recorded a net income of $2,793,913 and $4,494,480 for the three and nine months ended September 30, 2021 compared to a net income of $419,589 for the three months ended September 30, 2020 and a net loss of $122,771 for the nine months ended September 30, 2020. This significant increase was also driven by increased revenues, improved gross margins, and reduced operating expenses.

“As noted in our third quarter performance update, Q3 has provided another record quarter for the Company. These results were thanks to strong demand and hard work from the entire AEP team to improve efficiency and successfully maneuver us through fluctuating material prices and both material and labour shortages,” said Melissa MacRae, Interim CFO. “We are all looking forward to what our fourth quarter is going to bring to finish out our results for 2021.”

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

For further information please contact:

Atlas Engineered Products Ltd.

Phone: 1-250-754-1400

Email: [email protected]

PO Box 37036 Country Club PO

Nanaimo, BC V9T 6N4

www.atlasengineeredproducts.com

For investor relations please contact:

Paul Andreola, Director

Phone: 1-604-644-0072

Email: [email protected]

Atlas Engineered Products Ltd.

PO Box 37036 Country Club PO

Nanaimo, BC V9T 6N4

www.atlasengineeredproducts.com

FORWARD LOOKING INFORMATION

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Although AEP believes that the expectations reflected in the forward looking statements are reasonable, there is no assurance that such expectations will prove to be correct, or that such future events will occur in the disclosed time frames or at all. AEP cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond AEP’s control. Such factors include, among other things: Risks and uncertainties relating to AEP, including those to be described in the Management’s Discussion and Analysis (“MD&A”) for AEP’s three months ended March 31, 2021. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, AEP undertakes no obligation to publicly update or revise forward-looking information.

SELECTED FINANCIAL INFORMATION

Except as noted below, the financial information provided in this news release is derived from the AEP’s unaudited financial statements for the three months ended March 31, 2021 and the related notes thereto as prepared in accordance with International Financial Reporting Standards (“IFRS”) and related IFRS Interpretations Committee (“IFRICs”) as issued by the International Accounting Standards Board (“IASB”). A copy of AEP’s unaudited financial statements for the three months ended March 31, 2021 and the related Management’s Discussion and Analysis is available on AEP’s website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com. Financial information for AEP’s acquisitions are included in AEP’s unaudited financial statements from the date of acquisition. Financial information for acquired businesses for periods prior to the date of acquisition were prepared by management and have not been reviewed or audited by independent auditors.

NON-GAAP/NON-IFRS FINANCIAL MEASURES

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP’s operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release may include “EBITDA”, “EBITDA margin”, “adjusted EBITDA”, “adjusted EBITDA margin”, “normalized EBITDA” and “normalized EBITDA margin”. “EBITDA” is calculated as revenue less operating expenses before interest expense, interest income, amortization and depletion, impairment charges, and income taxes. “EBITDA margin” is EBITDA expressed as a percentage of revenues. “Adjusted EBITDA” is EBITDA after adjusting for share-based payments, foreign exchange gains or losses and non-recurring items. “Adjusted EBITDA margin” is adjusted EBITDA expressed as a percentage of revenues. “Normalized EBITDA” is EBITDA adjusted for one-time items. “Normalized EBITDA margin” is normalized EBITDA expressed as a percentage of revenues.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.