Atlas Engineered Products Reports Record 2022 Year End and Fourth Quarter Financial and Operating Results

April 20, 2023

NANAIMO, BC, April 20, 2023 /CNW/ - Atlas Engineered Products ("AEP" or the "Company") (TSXV: AEP) (OTC Markets: APEUF) is pleased to announce its financial and operating results for the year ended December 31, 2022. All amounts are presented in Canadian dollars.

"The AEP team continued to work hard to overcome all the challenges that 2022 brought our way, which I believe shows in our fiscal 2022 results. I am very proud of the team and these results," said Hadi Abassi, CEO & President and Founder of AEP. "We are looking forward to 2023 and all the opportunities that are available through organic and potential acquisitive growth."

Financial Highlights for Fourth Quarter and Fiscal 2022:

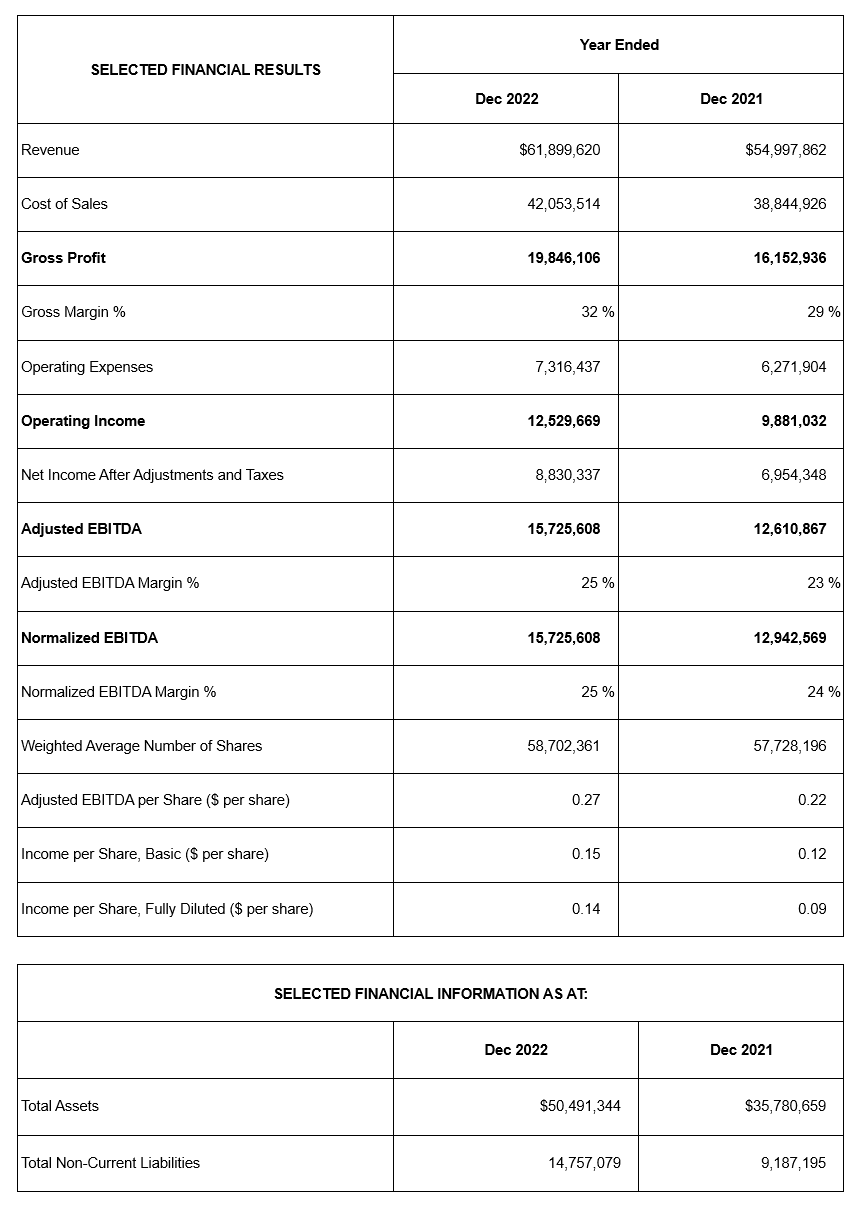

- Revenue increased 13% to $61,899,620 for the year ended December 31, 2022 from $54,997,862 for the year ended December 31, 2021. Overall revenue for the three months ended December 31, 2022 was $14,990,588, representing an 8% improvement compared to revenue of $13,896,440 for the three months ended December 31, 2021.

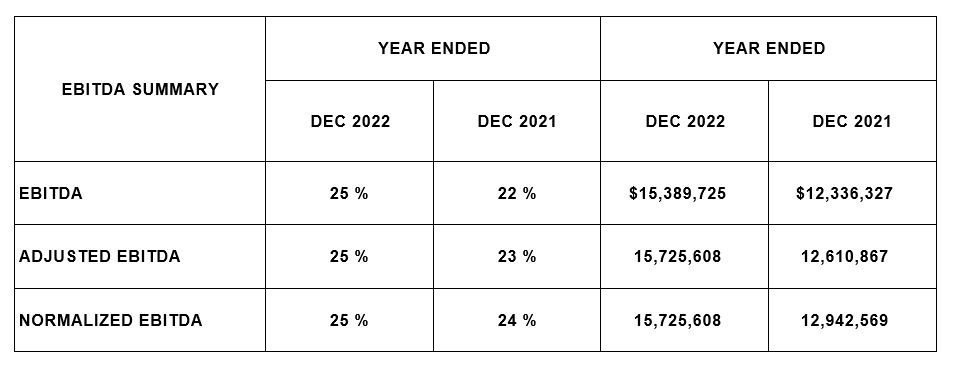

- Non-IFRS measure adjusted EBITDA margin for the year ended December 31, 2022 was $15,725,608 with an adjusted EBITDA margin of 25%. Adjusted EBITDA for the year ended December 31, 2021 was $12,610,867 with an adjusted EBITDA margin of 23%. Adjusted EBITDA and adjusted EBITDA margin for the year ended December 31, 2022 increased compared to the year ended December 31, 2021 due to increased net income resulting from increased sales, organic growth, the addition of Hi-Tec, and improved gross margins.

- Gross margin increased to 32% for the year ended December 31, 2022 compared to 29% for the year ended December 31, 2021, an 9% increase. Gross margin decreased to 34% for the three months ended December 31, 2022 compared to 37% for the three months ended December 31, 2021. Gross margins increased for the year ended due to continued constant pricing assessments based on fluctuating raw material costs, as well as, improving efficiencies on new product lines and acquisitions. Gross margin decreased for the three months ended December 31, 2022 due to rising interest rates which have put downward pressure on the housing market creating a more competitive market. As the market becomes more competitive, the Company continues to assess its internal pricing strategies to be competitive while still maintaining good margins and furthering organic growth.

- The Company recorded net income after taxes of $8,830,337 for the year ended December 31, 2022 compared to net income after taxes of $6,954,348 for the year ended December 31, 2021. This increase was primarily due to the increase in revenues, improvements in gross margins, and the operations of Hi-Tec added during the year ended December 31, 2022.

Expansion during 2022:

On February 28, 2022 , the Company acquired Hi-Tec Industries Ltd. ("Hi-Tec") located in Lantzville, BC on Vancouver Island. Since purchasing Hi-Tec Industries on February 28, 2022 , this operation contributed $982,503 in revenues and approximately $231,026 in EBITDA for the three months ended December 31, 2022 and $5,424,473 in revenues and approximately $1,509,859 in EBITDA for the year ended December 31, 2022. AEP has been working on integration of this location which has included a number of synergies with AEP's Atlas Building System Ltd. location, which include labour, shipping, and equipment.

Normal Course Issuer Bid ("NCIB") Update:

The Company commenced an NCIB on November 3, 2021 which ended on November 3, 2022, during which time the Company purchased and cancelled a total of 2,886,286 common shares at a weighted average price of $0.553 per share.

AEP received approval for the TSX Venture Exchange to renew its NCIB to be transacted through the facilities of the TSXV. The renewed NCIB commenced on December 1, 2022 and will end on December 1, 2023 or such earlier date as AEP may complete its purchases as set forth in its notice filed with the TSXV. Under the renewed NCIB, AEP may purchase up to 4,732,015 common shares of the Company, representing up to 10% of the Company's Public Float as of November 2, 2022. From December 1, 2022 up to this news release the Company has purchased for cancellation a total of 718,000 common shares at a weighted average price of approximately $0.760 per share.

AEP's board of directors continues to believe that the current market price for the Company's common shares does not currently reflect the underlying value of the Company. As a result, depending on future price movements and other factors, AEP's board of directors believes that the purchase of the shares is an appropriate use of AEP's funds and in the best interests of AEP's shareholders.

Outlook for 2023:

AEP will continue to assess M&A opportunities that fit with the Company's goals and strategies, while also working to bring the latest automation to improve operational efficiencies, and adding new products and services to better serve our customers.

The Company expects to enter into a more competitive market for 2023 as interest rates have risen in order to slow inflation., which affects the housing market after the last few years of high material prices and significant increases in housing starts. The Company currently anticipates that increased interest rates will have a minimal overall affect on the housing market given the number of homes that are still needed to support Canada's continued population growth and immigration. The Company will continue to monitor the effects of interest rates on the housing market, and is prepared to manage pricing and explore new markets in order to continue to drive organic growth as much as possible in 2023.

Non-GAAP / Non-IFRS Financial Measures:

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP's operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release may include "EBITDA", "EBITDA margin", "adjusted EBITDA", "adjusted EBITDA margin", "normalized EBITDA" and "normalized EBITDA margin". For a description of the composition of these measures, please refer to AEP's Management's Discussion and Analysis for the year ended December 31, 2021 under "Non-IFRS / Non-GAAP Financial Measures", available on AEP's website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com.

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively and apply new technologies, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

For additional information please contact:

Jake Bouma, Representative for AEP

Phone: 1-604-317-3936 Email: [email protected]

Company contact details:

Hadi Abassi, CEO & President, Founder

Atlas Engineered Products Ltd. Email: [email protected]

250-754-1400

PO Box 37036 Country Club PO

Nanaimo, BC V9T 6N4 www.atlasengineeredproducts.com

FORWARD-LOOKING INFORMATION

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Although AEP believes that the expectations reflected in the forward looking statements are reasonable, there is no assurance that such expectations will prove to be correct, or that such future events will occur in the disclosed time frames or at all. AEP cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond AEP’s control. Such factors include, among other things: Risks and uncertainties relating to AEP, including those to be described in the Management’s Discussion and Analysis (“MD&A”) for AEP’s three months ended March 31, 2023. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, AEP undertakes no obligation to publicly update or revise forward-looking information.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.