Atlas Engineered Products Reports 2020 Year End Financial and Operating Results and Record Fourth Quarter Revenues

April 15, 2021

April 15, 2021 - Nanaimo, British Columbia / Atlas Engineered Products (“AEP” or the “Company”) (TSX-V: AEP; OTC Markets: APEUF) is pleased to announce its financial and operating results for the year ended December 31, 2020. All amounts are presented in Canadian dollars.

“2020 presented many challenges for AEP brought on by the COVID-19 pandemic. Rapidly increasing material prices, shipping logistic difficulties, and social distancing were only some of the challenges faced in 2020 and ongoing to 2021. Throughout this, the health of our employees and customers was always our main focus,” said Hadi Abassi, CEO & President, Founder. “Despite the obstacles of 2020, the entire Company has worked hard to improve profitability and to position itself to take advantage of the strong demand for our products through organic growth and diversity.”

Financial Highlights for Fourth Quarter and Fiscal 2020:

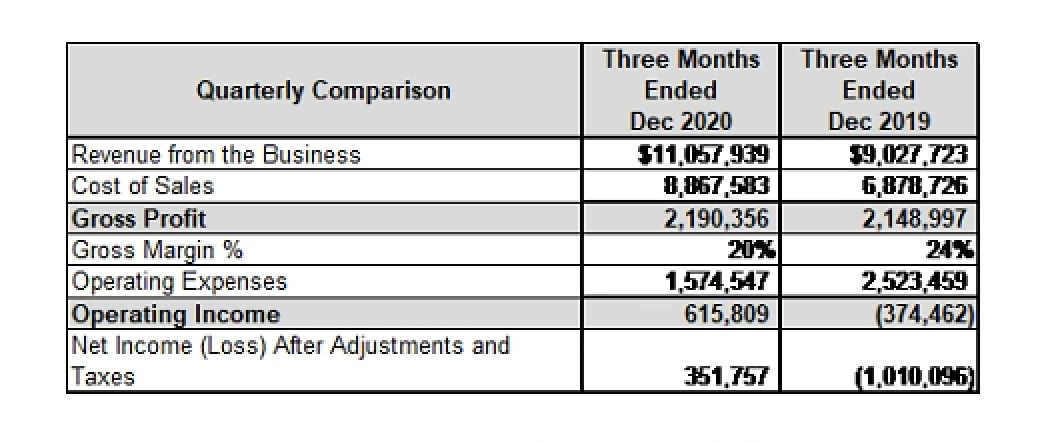

· Fourth-quarter results for the three months ended December 31, 2020 compared to the three months ended December 31, 2019 resulted in the Company’s best fourth quarter to date. The following table demonstrates the improvements in revenue, operating expenses, and net income after adjustments and taxes. This also highlights the substantial drop in operating expenses of $948,912 through the Company’s cost-cutting strategies. The majority of these cost-cutting strategies are permanent and include contract cancellations for substantially completed projects, staffing restructuring, and bringing projects in-house where staff had the skill and capacity to complete efficiently.

· During December 2020, the Company signed a new credit facility agreement with TD Canada Trust. The new agreement has three facilities and updated covenants offering the Company greater flexibility for future M&A activities and equipment upgrades. Excess funds were used to pay off additional debt and lease facilities during this refinancing which improved the Company’s balance sheet and reduced the interest cost to the Company.

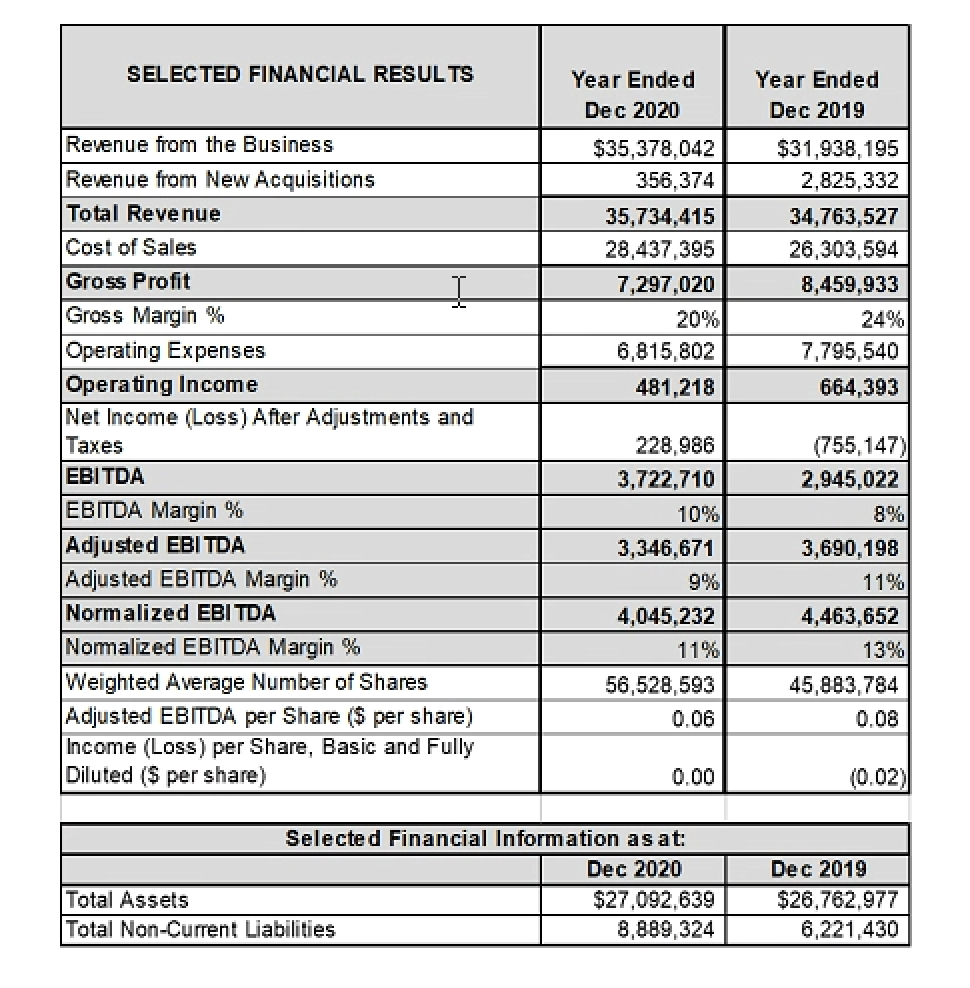

· Revenue increased 22% to $11,057,939 for the three months ended December 31, 2020 from $9,027,723 for the three months ended December 31, 2019. This increase represents the Company’s best fourth quarter to date. Overall revenue for the year ended December 31, 2020 was $35,734,415, representing a 3% improvement compared to revenue of $34,763,527 for the year ended December 31, 2019 despite the COVID-19 pandemic.

· During the year ended December 31, 2020, AEP completed the acquisition of the assets of Trusstem Industries Inc and began operations as Novum Building Components Ltd (“Novum”) on July 20, 2020 in Abbotsford, British Columbia.

· Operating expenses were $6,815,802 for the year ended December 31, 2020 compared to $7,795,540 for the year ended December 31, 2019, representing an improvement of 12.6%. Operating expenses have decreased sharply as the Company implemented cost-cutting strategies during the year ended December 31, 2020.

· The Company recorded a net income of $351,757 for the three months ended December 31, 2020 compared to a net loss of $(1,010,096) for the three months ended December 31, 2019. This substantial increase was driven by increased revenues, significantly reduced operating expenses, and a reduction in non-cash write-offs. Additionally, net income was $228,986 for the year ended December 31, 2020 compared to net loss of $(755,147) for the year ended December 31, 2019, another substantial improvement partly due to the Canadian emergency wage subsidy as well. The Company has not qualified for this subsidy since the third quarter due to increased revenues compared to the prior year.

· Non-IFRS measure EBITDA margin increased to 10% for the year ended December 31, 2020 from 8% for the year ended December 31, 2019, due to increased net income for the year resulting from reduced operating expenses and the Canadian emergency wage subsidy

Expansion & Optimization for 2020:

· In July 2020, with the start of the operations of Novum, the Company has entered directly into the lower mainland market of British Columbia where there is the opportunity for significant growth and expanded reach throughout the province.

· The Company also continued to focus on organic growth and product diversification. On October 6, 2020, the Company announced its expansion into pre-fabricated wall panel production for the British Columbia market. This has created an opportunity for the Company to provide a cost-effective alternative to framing onsite while making Atlas a true turn-key solution provider to our valued customers.

Outlook for 2021:

The construction industry has remained strong through the beginning of 2021. With this strong start to 2021, AEP expects to see this impact in the First-Quarter as the Company has continued to focus on operational and technological improvements to take advantage of the strong construction industry. Although the COVID-19 pandemic continues to provide challenges in 2021 from ongoing health orders to material pricing and shortages. The Company continues to work through these challenges to mitigate their impacts on performance.

AEP continues to assess M&A opportunities that fit with the Company’s goals and strategies. This has been bolstered by the new financing and credit partnership with TD Canada Trust giving the Company access to more funding for acquisitive growth.

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively and apply new technologies, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

For further information please contact:

Atlas Engineered Products Ltd.

Phone: 1-250-754-1400 Email: [email protected]

PO Box 37036 Country Club PO

Nanaimo, BC V9T 6N4

www.atlasengineeredproducts.com

For investor relations please contact:

Paul Andreola, Director

Phone: 1-604-644-0072 Email: [email protected]

Atlas Engineered Products Ltd.

PO Box 37036 Country Club PO

Nanaimo, BC V9T 6N4

www.atlasengineeredproducts.com

FORWARD-LOOKING INFORMATION

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Although AEP believes that the expectations reflected in the forward looking statements are reasonable, there is no assurance that such expectations will prove to be correct, or that such future events will occur in the disclosed time frames or at all. AEP cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond AEP’s control. Such factors include, among other things: Risks and uncertainties relating to AEP, including those to be described in the Management’s Discussion and Analysis (“MD&A”) for AEP’s year ended December 31, 2020. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, AEP undertakes no obligation to publicly update or revise forward-looking information.

SELECTED FINANCIAL INFORMATION

Except as noted below, the financial information provided in this news release is derived from the AEP’s audited financial statements for the year ended December 31, 2020 and the related notes thereto as prepared in accordance with International Financial Reporting Standards (“IFRS”) and related IFRS Interpretations Committee (“IFRICs”) as issued by the International Accounting Standards Board (“IASB”). A copy of AEP’s financial statements for the year ended December 31, 2020 and the related Management’s Discussion and Analysis is available on AEP’s website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com.

Financial information for AEP’s acquisitions are included in AEP’s unaudited financial statements from the date of acquisition. Financial information for acquired businesses for periods prior to the date of acquisition were prepared by management and have not been reviewed or audited by independent auditors.

NON-GAAP/NON-IFRS FINANCIAL MEASURES

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP’s operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release may include “EBITDA”, “EBITDA margin”, “adjusted EBITDA”, “adjusted EBITDA margin”, “normalized EBITDA” and “normalized EBITDA margin”. “EBITDA” is calculated as revenue less operating expenses before interest expense, interest income, amortization and depletion, impairment charges, and income taxes. “EBITDA margin” is EBITDA expressed as a percentage of revenues. “Adjusted EBITDA” is EBITDA after adjusting for share-based payments, foreign exchange gains or losses and non-recurring items. “Adjusted EBITDA margin” is adjusted EBITDA expressed as a percentage of revenues. “Normalized EBITDA” is EBITDA adjusted for one-time items. “Normalized EBITDA margin” is normalized EBITDA expressed as a percentage of revenues.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.