Atlas Engineered Products Reports 2019 Year End Financial and Operating Results

April 30, 2020

Nanaimo, British Columbia / Atlas Engineered Products (“AEP” or the “Company”) (TSX-V: AEP; OTC Markets: APEUF) is pleased to announce its financial and operating results for the year ended December 31, 2019. All amounts are presented in Canadian dollars.

“AEP is well capitalized and fiscally disciplined. We accomplished an exceptional turn-around in 2019, that has set the foundation for us to start a new year in a solid financial position, with a strong orderbook.” Says Melissa MacRae, Interim CFO.

Financial Highlights for Fiscal 2019:

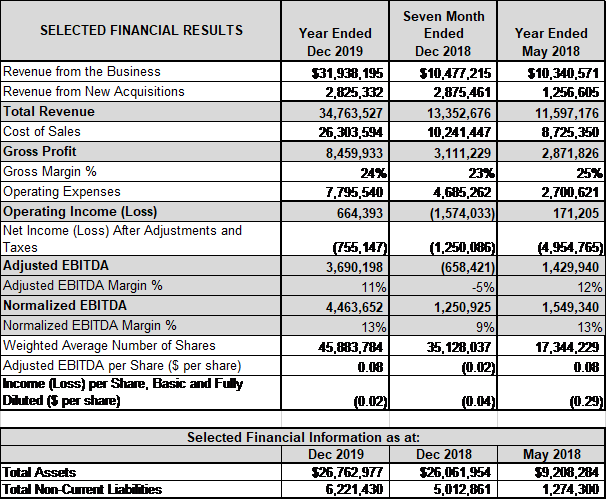

- Overall revenue for the year ended December 31, 2019 was $34,763,527, up from $13,352,676 for the seven months ended December 31, 2018 and $11,597,176, representing an overall growth in total revenue from the comparative periods of 160% and 200%, respectively. This increase in total revenues was driven by the completion of acquisitions during the year and the organic growth of AEP’s existing operations.

- During the year ended December 31, 2018, AEP completed the acquisition of South Central Building Systems in March of 2019.

- AEP generated a positive adjusted EBITDA margin (11%) for the year ended December 31, 2019, as compared to a negative adjusted EBITDA (-5%) for the seven months ended December 31, 2018. Normalized EBITDA margin for the year ended December 31, 2019 increased to 13% as compared to 9% for the seven months ended December 31, 2018.

- Gross margins were also significantly improved by the year ended December 31, 2019 as compared to the start of 2019. After beginning the year with a gross margin of 19% for Q1 2019, we finished with a gross margin of 24% for Q4 2019, representing a 26% increase.

- We took a disciplined and prudent review of our balance sheet at December 31, 2019, especially in the light of the evolving COVID-19 concern. There was an assessed impairment of goodwill, and a loan receivable originating in 2017, that was written off due to lack of principle repayments received during the latter part of 2019. Other one-time or non-recurring costs that affected our year end results included: ongoing restructuring and severances as we continue to combine functions and maximize synergies, developmental costs, and a ramp-up in organizational costs for anticipated product launches and acquisitive activities. The balance sheet adjustments, and one-time or non-recurring costs accounted for around $1.1m, pushing the business to negative net income for the year. These costs are non-recurring and underscores the business’ good health into 2020.

2019 Integration and Optimization Strategy:

- AEP completed a needs assessment from which we developed integration plans. These plans addressed areas for operational and financial improvements, within the newly acquired companies, resulting in significant savings, after restructuring costs in 2019;

- We worked incredibly hard to optimize workflows, productivity, and capitalize on economies of scale - such as a national lumber supply agreement. These activities contributed to the 26% growth in Gross Margin;

- In the spring of 2019, with the acquisition of SC Building Systems in Manitoba, AEP entered the Prairies and expanded into new geographical markets. Meanwhile, we penetrated the North and South Vancouver Island markets and targeted areas in Ontario to secure a comprehensive national footprint of product and service delivery;

- We aggressively focused on product diversification which resulted in the delivery of record revenues and significant improvements in EBITDA.

Dirk Maritz, President and CEO of AEP stated, “2019 was truly about integration and optimization. We took a pause on acquisitions to ensure our operations across Canada had strong revenues, standardized practices, effective workflow improvements and strategic implementation of new products. Since going public on November 6, 2017, we have grown our Canadian footprint to six operations in British Columbia, Manitoba and Ontario. Month by month we continue to strengthen our financial and operational performance and execute on our overall growth strategy. This is an excellent First-Year result for the newly formed AEP team, and we have only just started.”

About Atlas Engineered Products Ltd.

AEP is a growth company that is acquiring and operating profitable, well-established operations in Canada’s truss and engineered products industry. We have a well-defined and disciplined acquisition and operating growth strategy enabling us to scale aggressively, giving us a unique opportunity to consolidate a fragmented industry of independent operators.

For further information please contact:

Atlas Engineered Products Ltd.

Phone: 1-250-754-1400

Email: [email protected]

Unit 102, 6551 Aulds Road

Nanaimo, BC V9S 5X9

www.atlasengineeredproducts.com

For investor relations please contact:

Brittany Ray-Wilks, Executive Vice President

Phone: 1-250-754-1400

Email: [email protected]

Atlas Engineered Products Ltd.

Unit 102, 6551 Aulds Road

Nanaimo, BC V9S 5X9

www.atlasengineeredproducts.com

Forward Looking Information

Information set forth in this news release contains forward-looking statements. These statements reflect management’s current estimates, beliefs, intentions and expectations; they are not guarantees of future performance. Although AEP believes that the expectations reflected in the forward looking statements are reasonable, there is no assurance that such expectations will prove to be correct, or that such future events will occur in the disclosed time frames or at all. AEP cautions that all forward looking statements are inherently uncertain and that actual performance may be affected by a number of material factors, many of which are beyond AEP’s control. Such factors include, among other things: Risks and uncertainties relating to AEP, including those to be described in the Management’s Discussion and Analysis (“MD&A”) for AEP’s year ended December 31, 2019. Accordingly, actual and future events, conditions and results may differ materially from the estimates, beliefs, intentions and expectations expressed or implied in the forward-looking information. Except as required under applicable securities legislation, AEP undertakes no obligation to publicly update or revise forward-looking information.

Selected Financial Information

Except as noted below, the financial information provided in this news release is derived from the AEP’s audited financial statements for the transition year ended December 31, 2019 and the related notes thereto as prepared in accordance with International Financial Reporting Standards (“IFRS”) and related IFRS Interpretations Committee (“IFRICs”) as issued by the International Accounting Standards Board (“IASB”). A copy of AEP’s audited financial statements for the transition year ended December 31, 2019 and the related Management’s Discussion and Analysis is available on AEP’s website at www.atlasengineeredproducts.com or on SEDAR at www.sedar.com.

Financial information for AEP’s acquisitions are included in AEP’s audited financial statements from the date of acquisition. Financial information for acquired businesses for periods prior to the date of acquisition were prepared by management and have not been reviewed or audited by independent auditors.

Non-GAAP / Non-IFRS Financial Measures

Certain financial measures in this news release do not have any standardized meaning under IFRS and, therefore are considered non-IFRS or non-GAAP measures. These non-IFRS measures are used by management to facilitate the analysis and comparison of period-to-period operating results for AEP and to assess whether AEP’s operations are generating sufficient operating cash flow to fund working capital needs and to fund capital expenditures. As these non-IFRS measures do not have any standardized meaning under IFRS, these measures may not be comparable to similar measures presented by other issuers. The non-IFRS measures used in this news release include “EBITDA”, “EBITDA margin”, “adjusted EBITDA”, “adjusted EBITDA margin”, “normalized EBITDA” and “normalized EBITDA margin”. “EBITDA” is calculated as revenue less operating expenses before interest expense, interest income, amortization and depletion, impairment charges, and income taxes. “EBITDA margin” is EBITDA expressed as a percentage of revenues. “Adjusted EBITDA” is EBITDA after adjusting for share-based payments, foreign exchange gains or losses and non-recurring items. “Adjusted EBITDA margin” is adjusted EBITDA expressed as a percentage of revenues. “Normalized EBITDA” is EBITDA adjusted for one-time items. “Normalized EBITDA margin” is normalized EBITDA expressed as a percentage of revenues.

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.